The results from our latest Semi-Annual U.S. Insurance Labor Outlook Study are now available!

The results from our latest Semi-Annual U.S. Insurance Labor Outlook Study are now available!

Read on for highlights from the most recent study.

The survey expectations for staffing remain positive. Although the rate of expected hiring decreased to 61 percent from 63 percent in July 2018, half of all carriers are planning to increase their staff by at least two percent in the coming year. Primary drivers for this staffing growth are the expansion of business into new markets and the anticipated increase in business volume. The post-recession recovery continues to influence staffing expectations as 43 percent of insurers reported they would be hiring to fill areas currently understaffed.

Revenue growth expectations also remain high, with 79 percent of surveyed organizations expecting an increase in revenue growth in 2019, a slight decrease from 82 percent in July 2018. An increase in market share is the primary driver of the expected revenue increases.

Revenue growth expectations also remain high, with 79 percent of surveyed organizations expecting an increase in revenue growth in 2019, a slight decrease from 82 percent in July 2018. An increase in market share is the primary driver of the expected revenue increases.

Despite a positive outlook, today’s insurers face an increasingly challenging labor market, as the demand for talent continues to surpass the current supply. Since its low in April 2011, the industry has added 108,300 new jobs, totaling 1,528,800 jobs in December 2018 – the highest since November 2003. If we add in the 278,000 insurance job openings, it is clear the labor market is in the midst of a drastic tightening.

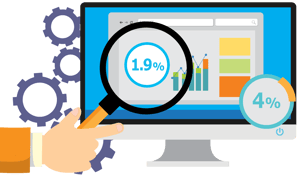

Moreover, the unemployment rate remains low. According to the Bureau of Labor Statistics, the January 2019 unemployment rate for the insurance industry was 1.9 percent, a much lower rate than the 4 percent reported for the general economy. The low unemployment rate speaks to the current talent crunch, increasing the difficulty insurers experience recruiting in the evolving talent marketplace.

Moreover, the unemployment rate remains low. According to the Bureau of Labor Statistics, the January 2019 unemployment rate for the insurance industry was 1.9 percent, a much lower rate than the 4 percent reported for the general economy. The low unemployment rate speaks to the current talent crunch, increasing the difficulty insurers experience recruiting in the evolving talent marketplace.

Companies are already reporting a challenging recruitment climate. The current labor market will become more and more challenging as the available talent pool continues to shrink due to impending mass retirements and lack of incumbent talent. Technology, executives and actuarial positions continue to top the list of most difficult-to-fill job functions. This correlates to the growing focus on technology and analytics within the industry and rise of the Future of Work. As a matter of fact, technology has had the greatest likelihood of increasing staff in 18 of the past 20 survey iterations.

To combat the talent crisis and meet the growing industry needs, insurers are increasingly relying on temporary staffing solutions. Already, interim employment is up by 51,100 jobs since July 2018. During the next 12 months, 71 percent of companies surveyed expect to maintain their current number of temporary employees. Meanwhile, 18 percent anticipate an increase, which matches the highest level in the history of the study in July 2012. As the gig economy grows, insurers are tasked with overseeing a blended workforce of tenured and specialized contractors and permanent employees – adding a new layer of diversity among employee groups.

To combat the talent crisis and meet the growing industry needs, insurers are increasingly relying on temporary staffing solutions. Already, interim employment is up by 51,100 jobs since July 2018. During the next 12 months, 71 percent of companies surveyed expect to maintain their current number of temporary employees. Meanwhile, 18 percent anticipate an increase, which matches the highest level in the history of the study in July 2012. As the gig economy grows, insurers are tasked with overseeing a blended workforce of tenured and specialized contractors and permanent employees – adding a new layer of diversity among employee groups.

Although the industry continues to enjoy growth, rising staffing demands and a shallowing hiring pool are accelerating the need for new talent solutions. For further insights into the industry’s 2019 labor outlook, download the full results of the study.