The industry is in the midst of one of the tightest labor markets many have ever experienced. Job openings have peaked in the past few months, voluntary quits are high, and we’re continuing to see an industrywide realignment as both professionals and employers assess their long-term needs and desired working environments.

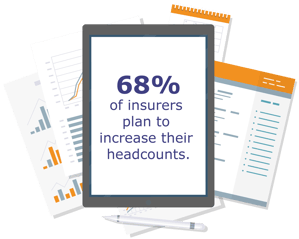

The results from our recent Q3 2022 Insurance Labor Market Study, conducted in partnership with Aon-Ward, indicate the tight market is not letting up any time soon. While 95% of insurance carriers plan to maintain or increase their headcounts throughout the next year, nearly half are finding their ability to hire more difficult than it was one year ago. This abundance of open roles provides a wealth of opportunities for professionals considering their next career move. Despite perceived uncertainty in the larger U.S. economy, 68% of insurers plan to add staff in the next year, which is 11 points higher than July 2021 and 5 points lower than January 2022. Anticipated increases in business volume is driving the need to add employees, followed by areas currently being understaffed. More than three-quarters of the insurers planning to hire seek experienced professionals, and 22% aim to hire entry-level employees. Of the 12 functions surveyed, actuarial is the most in need of entry-level individuals, with operations and claims close behind. As the industry continues to evolve and transform, technology roles remain in the highest demand, followed by underwriting and claims positions.

Despite perceived uncertainty in the larger U.S. economy, 68% of insurers plan to add staff in the next year, which is 11 points higher than July 2021 and 5 points lower than January 2022. Anticipated increases in business volume is driving the need to add employees, followed by areas currently being understaffed. More than three-quarters of the insurers planning to hire seek experienced professionals, and 22% aim to hire entry-level employees. Of the 12 functions surveyed, actuarial is the most in need of entry-level individuals, with operations and claims close behind. As the industry continues to evolve and transform, technology roles remain in the highest demand, followed by underwriting and claims positions.

Overall recruiting difficulty is unchanged from January, remaining at its highest level in the study's 13-year history. All functional areas except operations, sales/marketing and executive roles are considered more challenging to fill than one year ago. In addition to being most in demand, technology roles continue to be considered the most difficult to fill, followed by actuarial and analytics. Amid these hiring challenges, the use of temporary staff is also at an all-time high. Nearly all insurers (96%) plan to either increase or maintain their current use of temporary employees over the next 12 months. While COVID-19 restrictions have largely been lifted, flexibility continues to be a priority for most professionals. As organizations determine their longer-term operating plans, the majority of insurers plan to offer flexible working arrangements. Fifty-five percent of respondents plan to allow employees to work remotely full-time, up ten points from the January 2022 study. Additionally, 84% plan to offer hybrid work as offices reopen.

While COVID-19 restrictions have largely been lifted, flexibility continues to be a priority for most professionals. As organizations determine their longer-term operating plans, the majority of insurers plan to offer flexible working arrangements. Fifty-five percent of respondents plan to allow employees to work remotely full-time, up ten points from the January 2022 study. Additionally, 84% plan to offer hybrid work as offices reopen.

The Q3 2022 Insurance Labor Market Study took place from July 11 through July 31, 2022, with participation from insurance carriers across all industry sectors. The semi-annual survey collects and examines data on insurance industry hiring, as well as revenue trends and projections. For more insight on the industry’s hiring plans and additional labor market details, view the full report.

If you’re considering a career move, read our past posts on taking a mindful, focused and professional approach to your job search.