The results from the January 2014 iteration of our U.S. Insurance Labor Outlook Study are now in. The rate of hiring has increased to its highest point in the entire history of the study, with nearly 62% of survey participants responding that they intend to increase their staff during 2014. In addition, the BLS has reported the January 2014 unemployment rate within the industry to be at its lowest point since March 2007—2.0%. So what does this mean for the insurance industry?

The results from the January 2014 iteration of our U.S. Insurance Labor Outlook Study are now in. The rate of hiring has increased to its highest point in the entire history of the study, with nearly 62% of survey participants responding that they intend to increase their staff during 2014. In addition, the BLS has reported the January 2014 unemployment rate within the industry to be at its lowest point since March 2007—2.0%. So what does this mean for the insurance industry?

While low unemployment and an industry-wide push to fill open positions is certainly a positive trend, it does present its own set of challenges. The current recruiting difficulty that many companies are reporting will only intensify as the industry talent pool becomes depleted.

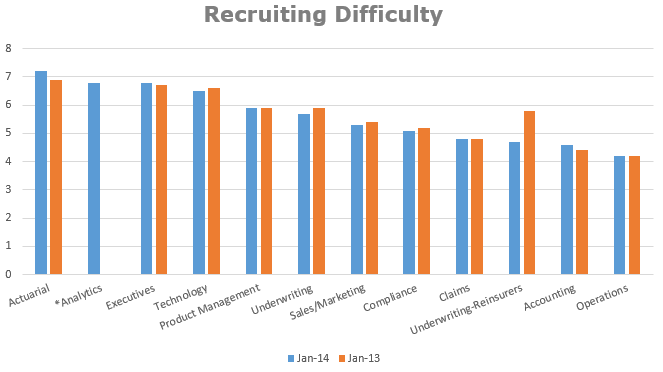

Compared to last year, survey respondents found that the recruiting climate for most functions continued to be moderately difficult, with some positions—including actuarial, analytics, executive and technology positions—becoming slightly more difficult to recruit for. Industry demand is now focused on technology, underwriting, claims and sales/marketing, with technology remaining the most likely position to be filled in 2014. This reflects the growing focus on technology within the insurance market.

Positions rated 5 or above are considered moderate or difficult to fill.

Positions rated 5 or above are considered moderate or difficult to fill.

The low unemployment rate and the recent upcoming hiring push have created a perfect storm in terms of talent shortage and companies must prepare. Looking forward, recruiting top talent, especially in high-demand roles will continue to be a challenge for companies. Focus must now shift towards the recruitment of young professionals, the engagement of individuals outside of the insurance industry and the hiring of subject matter experts in order to combat the growing skills gap and build a strong talent pipeline for the future. Jacobson has already begun targeting this growing need through our Emerging Talent program. This program, which aims to provide insurers with recent graduates and young professionals, has already begun shepherding new talent to our clients in an effort to offset the coming skills gap.