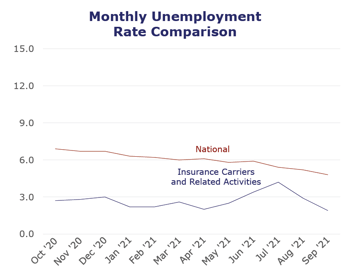

The insurance industry’s unemployment rate dropped a full percentage point to 1.9% in September, reaching its lowest since the start of the pandemic. However, while the unemployment rate is low, industry employment also continues to drop. This is likely due to the complexity of the job market, and the effects of not only the Great Reshuffle, but also the Great Realignment. As vaccine mandates are implemented within some organizations and we enter the winter months, individuals are likely to continue adjusting their priorities, expectations and goals.

The overall U.S. economy saw its lowest job gains of the year, as individuals continue to leave the workforce. In the tight labor market, it’s essential insurers retain top talent. Savvy leaders must focus on building strong remote and hybrid cultures while meeting shifting employee needs.

| Unemployment for the insurance carriers and related activities sector decreased to 1.9% in September. | |

| The insurance carriers and related activities sector lost 2,900 jobs in September. | |

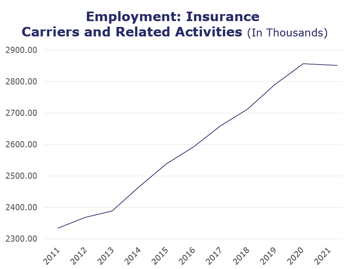

| At roughly 2.9 million jobs, industry employment decreased by approximately 6,000 jobs compared to September 2020. | |

| The U.S. unemployment rate decreased to 4.8% in September and the overall economy added 194,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, August* insurance industry employment saw job increases in title (up 11.3%), and agents/brokers (up 2.4%). Meanwhile, job decreases were seen for reinsurance (down 4.9%), property and casualty (down 2.7%), TPAs (down 1.5%), claims (down 0.3%) and life/health (down 0.3%).

- On a year-to-year basis, August* saw weekly wage increases in reinsurance (up 7.7%), TPAs (up 3.1%), life/health (up 2.2%) and agents/brokers (up 1.8%). Meanwhile, wage decreases were seen for title (down 5%), claims (down 0.8%) and property and casualty (down 0.1%).

BLS Reported Adjustments: Adjusted employment numbers for August show the industry saw an increase of 700 jobs, compared to the previously reported decrease of 800 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.