Job openings reached an all-time high in January, retirements are accelerating, and new roles are continuing to emerge within the industry. "A candidate’s market” has never more accurately described the insurance industry’s recruiting climate. According to our recent Q1 2022 Insurance Labor Market Study, conducted in partnership with Aon plc, 72% of insurers are planning to increase staff this year — a record high percentage and a 16-point increase from July 2021's study. If you’re looking to make a career move within the industry, now is an opportune time to start exploring your options, refresh your resume and ensure you’re prepared if your dream job presents itself.

As the industry experiences the most intense labor market many have ever seen, candidate expectations are setting the tone and driving the market. With a current industry unemployment rate of 1.8% and a record number of open finance and insurance jobs, talent is being pursued aggressively and savvy insurers are focused on how they can best meet shifting needs to increase fill rates and retention.

As the industry experiences the most intense labor market many have ever seen, candidate expectations are setting the tone and driving the market. With a current industry unemployment rate of 1.8% and a record number of open finance and insurance jobs, talent is being pursued aggressively and savvy insurers are focused on how they can best meet shifting needs to increase fill rates and retention.

According to our study, anticipated growth in business volume is the primary reason to add staff. Three-quarters of insurers seek experienced professionals, followed by 24% who aim to hire entry-level employees. Operations and claims are the functions most likely to hire entry-level individuals, at 45% and 33% respectively. Technology roles continue to be the most in-demand, followed by claims positions.

Overall recruiting difficulty is now at its highest level in the study's 13-year history. Every functional area was reported more challenging to fill than one year ago. Not surprisingly, technology roles continue to be the most difficult, followed by actuarial and analytics, respectively.

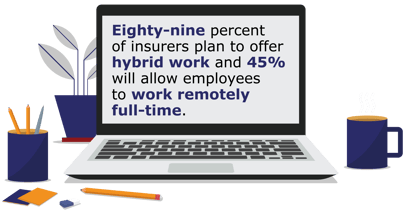

As recruiting becomes more challenging, the use of temporary staff is also increasing. The majority of insurers plan to maintain their current use of temporary employees and 19% plan to increase their temporary staff in 2022. This is the largest demand for temporary staffing in the study’s history. As you explore opportunities within the industry, consider what you need from an employer and the roles and organizations that best match those needs. As offices reopen, the majority of insurers plan to offer flexible work options. Eighty-nine percent plan to offer hybrid work and 45% will allow employees to work remotely full-time. Geography is becoming less of a limitation and enabling candidates to broaden their job searches without entertaining relocation.

As you explore opportunities within the industry, consider what you need from an employer and the roles and organizations that best match those needs. As offices reopen, the majority of insurers plan to offer flexible work options. Eighty-nine percent plan to offer hybrid work and 45% will allow employees to work remotely full-time. Geography is becoming less of a limitation and enabling candidates to broaden their job searches without entertaining relocation.

The Q1 2022 Insurance Labor Market Study took place from January 12 through January 30, 2022, with participation from insurance carriers across all industry sectors. The semi-annual survey collects and examines data on insurance industry hiring, as well as revenue trends and projections. For more insight on the industry’s hiring plans and additional labor market details, view the full report.