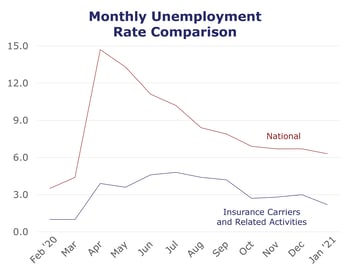

The insurance industry saw unemployment decline in January, starting the new year with a 2.2% unemployment rate. This is lower than 2020’s overall average unemployment rate of 3% and even January 2020’s 2.9% unemployment rate.

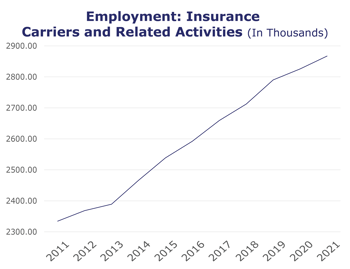

At the same time, the industry lost 9,300 jobs in January, marking its first decline since May 2020. However, it’s not uncommon for these numbers to be revised over time by the BLS. In total, the industry is starting 2021 with 53,300 more jobs than January 2020. Throughout 2020, the industry also saw average weekly earnings rise by 6.8%. This is compared to an annual increase of just 2.8% in 2019.

While the insurance industry remains relatively strong, the overall U.S. economy increased by just 49,000 jobs in January, maintaining a deficit of nearly 9.6 million jobs compared to January 2020.

| Unemployment for the insurance carriers and related activities sector decreased to 2.2% in January. | |

| The insurance carriers and related activities sector lost 9,300 jobs in January. | |

| The U.S. unemployment rate decreased to 6.3% in January with an increase of 49,000 jobs. | |

| At roughly 2.9 million jobs, industry employment increased by approximately 53,300 jobs compared to January 2020. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, December* insurance industry employment saw job increases in title (up 8.5%), claims (up 5.8%), property and casualty (up 2.4%), life/health (up 2.1%), and agents/brokers (up 1.8%). Meanwhile, job decreases were seen for reinsurance (down 4.3%) and TPAs (down 1.9%).

- On a year-to-year basis, December* marked the sixth consecutive month of industry-wide wage increases: reinsurance (up 26.8%), property and casualty (up 9.2%), title (up 6.8%), life/health (up 7.2%), agents/brokers (up 6.7%), TPAs (up 2.6%) and claims (up 1.0%).

BLS Reported Adjustments: Adjusted employment numbers for December show the industry saw an increase of 4,600 jobs, compared to the previous reported increase of 4,900 jobs.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.

For more insight on the industry’s labor outlook, join us for a complimentary webinar revealing the results of our Semi-Annual Insurance Industry Labor Market Outlook Study, conducted in partnership with Aon plc. The presentation will take place on February 11, 2021, at 1:00 p.m. CST. Register here.