Despite a sense of economic uncertainty, the insurance labor market does not seem to be cooling in the new year. The industry ended 2022 with roughly 40,000 more jobs than the start of the year and 10 consecutive months of wage increases. Voluntary quits and job openings within finance and insurance had slight dips in November*, but remain high.

Despite a sense of economic uncertainty, the insurance labor market does not seem to be cooling in the new year. The industry ended 2022 with roughly 40,000 more jobs than the start of the year and 10 consecutive months of wage increases. Voluntary quits and job openings within finance and insurance had slight dips in November*, but remain high.

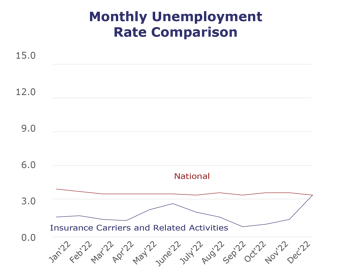

| Unemployment for the insurance carriers and related activities sector increased to 3.5% in December. | |

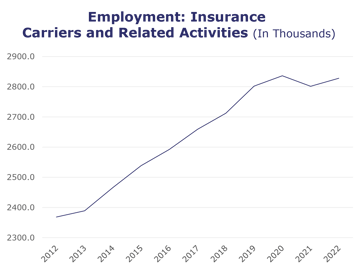

| The insurance carriers and related activities sector gained 3,800 jobs in December. | |

| At roughly 2.8 million jobs, industry employment increased by approximately 39,600 jobs compared to December 2021. | |

| The U.S. unemployment rate decreased to 3.5% in December and the overall economy added 223,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, November* insurance industry employment saw job increases in agents/brokers (up 3.5%), TPAs (up 2.2%), property and casualty (up 1.7%), and life/health (up 1%). Meanwhile, job decreases were seen in claims (down 12.2%), title (down 9.1%) and reinsurance (down 0.4%).

- On a year-to-year basis, November* saw weekly wage increases in property and casualty (up 10.1%), agents/brokers (up 5.9%), life/health (up 5.8%), TPAs (up 3.9%), reinsurance (up 2.4%), and title (up 1.5%). Meanwhile, wages decreased in claims (down 0.9%).

BLS Reported Adjustments: Adjusted employment numbers for November show the industry saw an increase of 1,500 jobs, compared to the previously reported increase of 3,800 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS JOLTS report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.