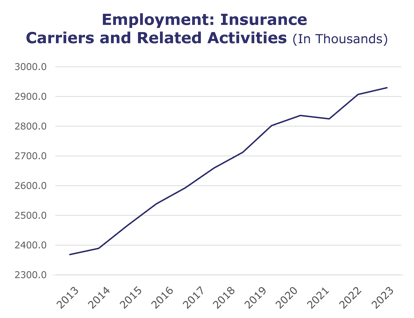

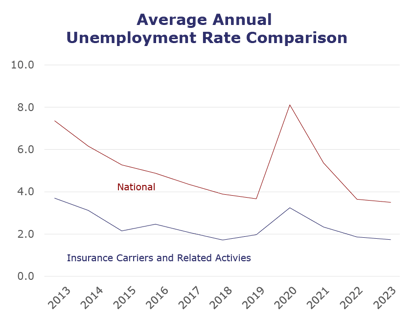

The insurance carriers and related activities sector experienced its third consecutive month of record high employment in June, reaching 2,945,300 individuals. Industry wages are also continuing to rise, with a 6.1% overall increase compared to one year ago.* Meanwhile, the insurance unemployment rate rose to 3.2% last month – the highest the industry has seen since June 2021. Yet, this spike is likely an anomaly, given the industry’s recent wage and employment gains.

| Unemployment for the insurance carriers and related activities sector increased to 3.2% in June. | |

| The insurance carriers and related activities sector gained 3,200 jobs in June. | |

| At more than 2.9 million jobs, industry employment increased by approximately 32,200 jobs compared to June 2022. | |

| The U.S. unemployment rate increased to 3.6% in June and the overall economy added 209,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, May* insurance industry employment saw job increases in TPAs (up 3.9%), life/health (up 1.8%), reinsurance (up 1.7%), property and casualty (up 1.6%), and agents/brokers (up 1.4%). Meanwhile, job decreases were seen in title (down 10.1%) and claims (down 6.7%).

- On a year-to-year basis, May* saw weekly wage increases in property and casualty (up 12.3%), title (up 6.5%), TPAs (up 6.2%), life/health (up 5.5%), agents/brokers (up 2.5%) and claims (up 2.2%). Meanwhile, wage decreases were seen in reinsurance (down 3.5%).

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.