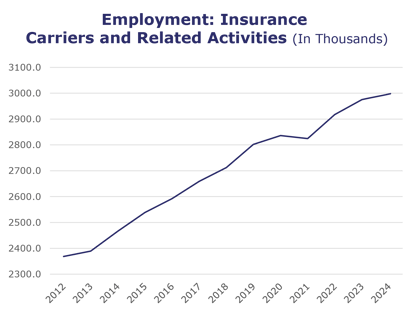

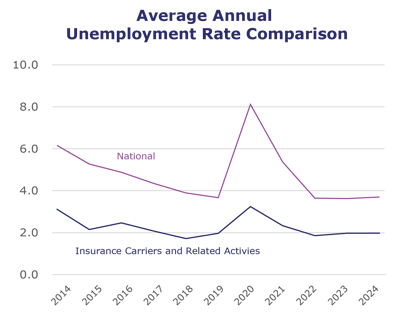

The unemployment rate for insurance carriers and related activities rose by .7 percentage points in April, yet hovers around 2%, consistent with the past several months. Industry employment also increased – adding more than 8,000 jobs after hitting the 3 million mark in March. The latest JOLTS report revised February job openings within the larger finance and insurance category, with new numbers showing 515,000 open jobs – a current record high. March* job openings also remained high, despite dropping to 365,000.

| Unemployment for the insurance carriers and related activities sector increased to 2.4% in April. | |

| The insurance carriers and related activities sector gained 8,100 jobs in April. | |

| At more than 3 million jobs, industry employment increased by approximately 43,200 jobs compared to April 2023. | |

| The U.S. unemployment rate slightly increased to 3.9% in April and the overall economy added 175,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, March* insurance industry employment saw job increases in claims (up 4.1%), reinsurance (up 3%), agents/brokers (up 2.9%), TPAs (up 1.6%), and life/health (up 1.1%). Meanwhile, jobs decreased in title (down 3.2%) and property and casualty (down 0.1%).

- On a year-to-year basis, March* saw weekly wage increases across all areas: title (up 14.9%), agents/brokers (up 9.8%), TPAs (up 9.7%), reinsurance (up 8%), life/health (up 5.6%), property and casualty (up 2.4%), and claims (up 0.9%).

BLS Reported Adjustments:

Adjusted employment numbers for March show the industry saw an increase of 1,800 jobs, compared to the previously reported decrease of 300 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.